April has been a busy month so far, with the new South African VAT rate now in full swing. Here is a summary of what we expected, what actually happened and any systems changes that may still be required.

1. XERO

what we expected

- New 15% rate added

- Old rate renamed

- Default inventory and contact rates changed to 15%

what actually happened

- The new rate appeared in Xero

- The 14% rate was only renamed if you were using the Xero defaults (this mainly affected older Xero accounts)

- Default inventory and chart of account rates changed to 15% (happened around the second week of April)

- Default contact rates not changed

systems changes that may still be required

- If you were previously using the Xero default rates and do not assign VAT your contacts then no further updates are required

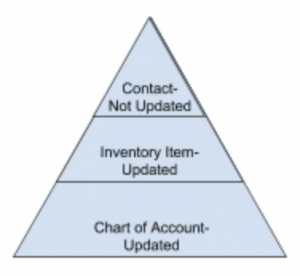

- There is a hierarchy used to determine the VAT rate on an invoice or bill which follows the image below:

- Most Xero users do not utilise the contact VAT rate feature, but if you do you will need to export all of your contacts, update the default VAT rate and re-import them

- For older Xero users who were not using the default VAT rates in Xero, you will need to update the Chart of Account defaults and any inventory item defaults, yourself

2. DEAR

what we expected

- New rules to automatically sync from Xero

- Rules to automatically be applied to SOs and POs (new rule would have the same name as the old rule previously had)

what actually happened

- Old rates remained customer and supplier defaults if you were not using the Xero default rates

- If Xero default rates were used in DEAR VAT rates flowed through to Customer, Supplier and Product setup correctly

systems changes that may still be required

- If you were using rates which were not the Xero defaults then you will need to export all of your customers, suppliers, and products, update the default VAT rate and re-import them

- The correct VAT rate names to include on the import can be found by navigating to Settings, Reference Books, Taxation Rules

3. SHOPIFY

what we expected

- A manual change of the VAT rate to 15% on 01 April 2018

what actually happened

- The rate changed automatically as Shopify changed their default VAT rate for South Africa

systems changes that may still be required

- If your Shopify sales are flowing into Xero with the wrong VAT rate applied or not flowing through to Xero at all, create a VAT rate called SH VAT Global, with the Tax Component – SH VAT GLOBAL @15% and assign it as the default rate for your Shopify Sales account

- Refresh your Xero settings in Shopify and try the Shopify export

4. VEND

what we expected

- A manual tax rate added – “VAT – 15%”, making this the default tax rate

- Linking this tax rate to the correct Xero VAT rate in the integration settings

what actually happened

- If product specific default tax rates were specified then these overrode the new rate which was added manually

systems changes that may still be required

- If you were using product-specific rates you will need to export all of your products, update the default VAT rate and re-import them

- If the new rate isn’t pulling through to your iPad then you will need to delete the VEND app and re-install it

5. RECEIPT BANK

what we expected

- Selecting “Allow Xero to decide” would ensure that the Xero defaults were applied

what actually happened

- Xero defaults were only changed later so new rates were not applied

systems changes that may still be required

- After making the relevant changes in Xero, follow the steps below;

- Ensure that the Tax Settings in the integrations setup are as follows;

- Publishing tax data – Allow Receipt Bank to decide

- Use tax list – On

- Use supplier tax rates – Off

- Ensure that before publishing a receipt the receipt details are as follows;

- Tax – Extracted amount (always double check this against the actual amount on the receipt, if the tax amount is incorrect, enter it manually or select the 15% rate)

- Ensure that the total amount matches the receipt

- Ensure that the Tax Settings in the integrations setup are as follows;

- Helpful tip

- To double check that Xero is setup correctly – Have a look at the tax default for the account that you would like to allocate the receipt to

If you are still struggling with any of the above please book a session with the systems team.

And feel free to send over any questions you may have regarding this month’s newsletter.

Jason Proctor (Creative CFO – Systems Team)