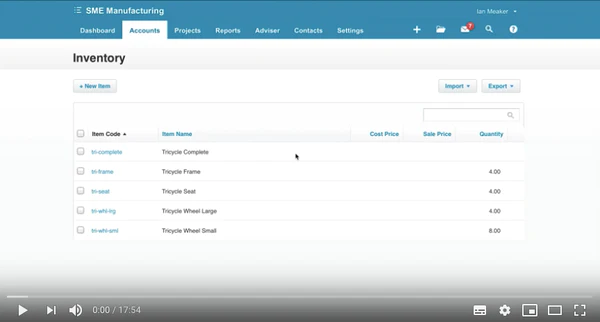

Method 3 – Manual Manufacture at the time of Assembly (finished goods represented in inventory)

The idea behind this approach is to buy in raw materials, track the quantity and value of those raw materials and then convert raw materials into tracked finished goods when you do an assembly in your workshop.

Xero transfers the value of the raw materials to the finished goods item so that when you sell a finished good Xero will automatically bring the cost of sales across from the inventory account.

You set this up by:

- Creating tracked inventory items in Xero for all your raw materials

- Creating tracked inventory items for your finished goods (similar to a service item)

The finished good is therefore represented in your inventory once you have done this process and will be visible on stock reports.

Method 3 Example – see video here!

You start the month with no stock.

- Create the following tracked inventory items for your materials:

- Bicycle frame

- Bicycle wheel

- Bicycle seat

- Create the following tracked inventory item for your finished good:

- Bicycle complete

- Buy in quantities of tracked inventory items with the following prices:

- Bicycle frame – QTY 5 at R750 each

- Bicycle wheel – QTY 5 at R250 each

- Bicycle seat – QTY 5 at R200 each

As Xero treats this as tracked inventory, you will see these values go directly to your balance sheet under inventory.

You’ll note that this should be enough to make 5 bicycles overall, with 1 frame, 2 wheels and 1 seat used in each assembly. This list is called thebill of materials as if you add up the numbers it should equate to R1400 of materials per completed bicycle.

Before you can make a sale of a tracked inventory item you must have stock of that item. Go test it, you will see in a sales invoice you can only create a draft and not an approved invoice for a complete bicycle.

So, let’s manufacture then.

We have two options to do this, one uses an invoice and one uses an inventory adjustment. Both work, the invoice method may be a bit quicker as you can do all the materials at once, the adjustment method does not leave a trail of ‘internal’ invoices.

- Manufacture 3 bicycles from the materials using an Invoice method

- Create a sales invoice and sell the correct amount of materials for 3 bicycles to the production contact. The selling price is Zero

- Note the impact on the profit and loss report. There should be R1400 x 3 = R4,200 in ‘Manufacturing Costs (should be zero)’

- Create a sales invoice and sell the correct amount of materials for 3 bicycles to the production contact. The selling price is Zero

-

- Create a purchase bill for 3 complete bicycles from the production contact. You need to use the overall value of the costs produced b the step above divided by the number of bicycles. For example, using our numbers above you will purchase in 3 complete bicycles at R1,400 each.

- Pay off the purchase to the ‘Manufacturing Costs (should be zero)’

- Note the impact on the profit and loss report. There should be no ‘Manufacturing Costs (should be zero)’ amount remaining.

- Pay off the purchase to the ‘Manufacturing Costs (should be zero)’

- Create a purchase bill for 3 complete bicycles from the production contact. You need to use the overall value of the costs produced b the step above divided by the number of bicycles. For example, using our numbers above you will purchase in 3 complete bicycles at R1,400 each.

- Manufacture 2 bicycles from the materials using an Inventory Adjustment method

- Sell the correct amount of materials for 2 bicycles to the production contact

- Purchase 2 complete bicycles from the production contact

Now let’s do a sale

- Sell 4 bicycles to a customer for R5,000 each

- Note the impact on the profit and loss report.

- Sales of R20,000. Cost of sales of R5,600 (4 bicycles @ R1,400 each)

- Note what remains on the balance sheet and your inventory reports

- One complete bicycle @ a value of R1,400

- Note the impact on the profit and loss report.

Note, you must perform the either of the two manufacture options, invoice or inventory adjustment, after each actual assembly in your workshop otherwise you will not be able to sell the finished goods in Xero.